Topics

How to Enter Education Loan Interest Information?

How Does Education Loan Interest Reduce Your Tax?

Proof Submission for Education Loan Interest

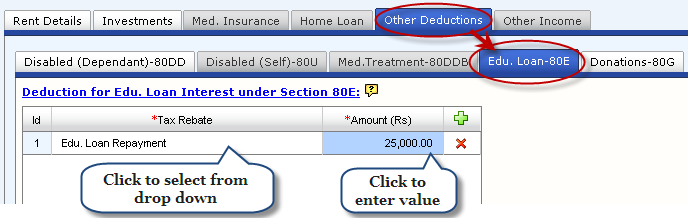

Deduction for Education Loan Interest under Section 80E

To claim deduction under Section 80E, please click on "Other Deductions" tab and then "Edu. Loan-80E" sub-tab.

As soon as you click on the![]() icon on top of the right extreme column in the table, you will see a row with blank fields. Please click on the respective cells to update information on interest payment on loan taken for higher education under Section 80E.

icon on top of the right extreme column in the table, you will see a row with blank fields. Please click on the respective cells to update information on interest payment on loan taken for higher education under Section 80E.

You can create as many rows as you wish to enter details in the respective fields by clicking ![]() the icon. If you wish to delete any of the rows, you could do so by clicking on the

the icon. If you wish to delete any of the rows, you could do so by clicking on the ![]() icon at the end of the row.

icon at the end of the row.

Field |

Instruction |

Tax Rebate |

Please select the appropriate tax rebate for which you wish to make the declaration by using the drop down. |

Amount |

Please enter the total amount of payment. The amount can have a maximum of 2 decimal places. |

How Does Education Loan Interest Reduce Your Tax?

Proof Submission for Education Loan Interest

The details for the various investment options along with the required proofs and guidelines are given below for your ready reference.

Under Section 80E |

Proof to be submitted |

Guidelines |

Education Loan Interest Benefit |

Letter / certificate from the Bank / Financial Institution specifying the following:

|

|

Copyright , Tandem Integrated Business Solutions Private Limited