Topics

What are Declarations for Tax Savings?

How to Submit Declarations for Tax Savings on Tanqaa?

What Are Declarations for Tax Savings?

Your organization will deduct tax on your salary, if your salary is higher than the statutorily-specified amount exempted from income tax. In order to reduce your tax liability, you can claim tax deductions under a variety of sections of the Indian income tax law. As the entity responsible for deducting tax from your salary and remitting the same to the tax department, your organization can allow you to submit certain declarations and correspondingly deduct lesser tax from your salary.

The amount of tax deducted on your salary is dependent on the availability of proof of investments/expenditures made for tax savings, submitted by you.

You can submit tax related declarations whenever you wish during a year. Please do not submit your tax related declarations towards the end of a year. Please submit your declarations at the beginning of a year or as soon as you join your organization, and make changes to your declarations as and when required. Tanqaa gives you the facility to submit your declarations online.

There are various sections under which you can claim exemptions. Of course, your declarations have to be as per what the tax law dictates. For each tax year, you need to submit provisional or initial tax saving investment declarations, and proof of investments thereof whenever your organization asks you to do so.

How to Submit Declarations for Tax Savings on Tanqaa?

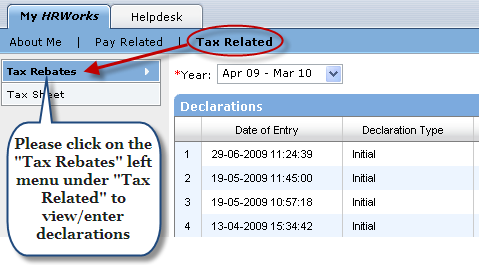

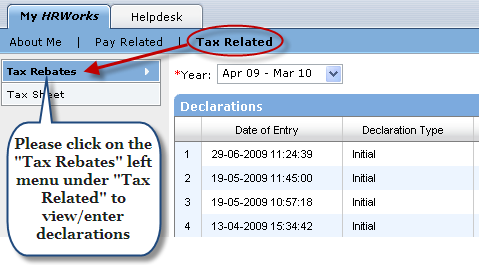

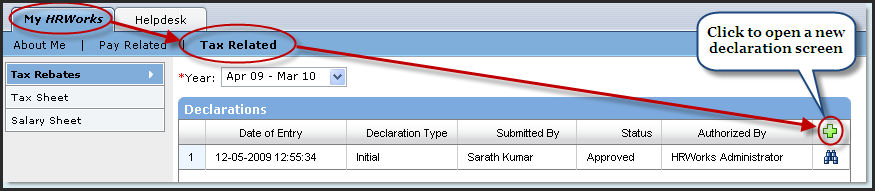

Please click on "Tax Rebates" menu under "Tanqaa" to enter/update your tax declaration for a year (Apr – Mar).

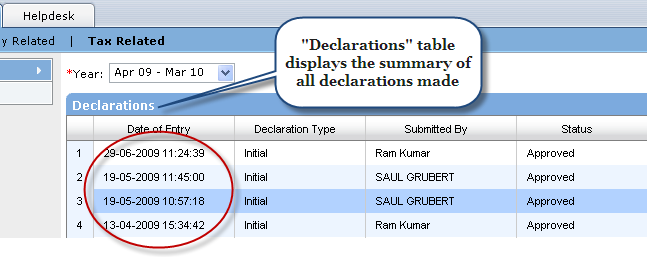

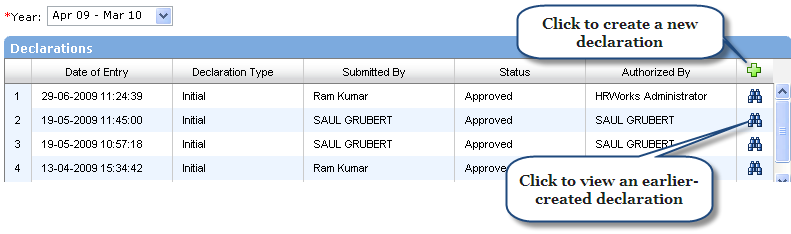

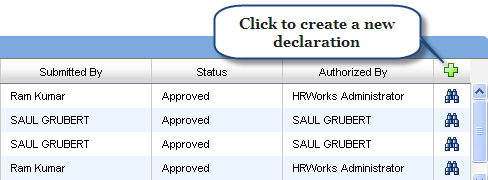

As soon as you click on the "Tax Rebates" left menu, you will see the current year, which is displayed as the default value for the "Year" drop down in the body of the web page. You can view declarations made by you for earlier years by selecting the year in the "Year" drop down. Just below the "Year" drop down, you can see the "Declarations" table which presents all the declaration you have made for the year. If you have not made any declarations for the year, you will see "No Data Found" in the "Declarations" table. If you have made any declaration, all the declarations will be presented as rows in the Declarations table.

Please use this screen to view an earlier submitted declaration or submit a new declaration. Please click on the  icon to view an earlier submitted declaration. As soon as you click on the

icon to view an earlier submitted declaration. As soon as you click on the  icon, you would see the corresponding declaration opening below the "Declarations" table. Please note that the details of an earlier-submitted declaration will be in the read-only mode and cannot be edited. Immediately below the "Declarations" table, the details of the last-entered declaration, if any, will be displayed in the read-only mode.

icon, you would see the corresponding declaration opening below the "Declarations" table. Please note that the details of an earlier-submitted declaration will be in the read-only mode and cannot be edited. Immediately below the "Declarations" table, the details of the last-entered declaration, if any, will be displayed in the read-only mode.

Fields in the "Declarations" table

Initial declarations are those which are typically submitted during the year and do not require proof of investments. Final declaration is submitted at the end of a tax year and you are expected to submit proof of your investments, as declared in your final declaration.

As and when an employee submits initial tax declaration, Tanqaa shall, depending on the setting made in the software, automatically accept the declaration and take the declaration information for computation of tax. Please note that Tanqaa compulsorily requires the final declaration to go through a process of authorization.

On account of the logic made use of in Tanqaa for the monthly tax apportionment, any changes to the declarations during a year could lead to variations in tax deductions from one month to another on Tanqaa. You can submit and re-submit tax related declarations on Tanqaa as many times as you wish until the time – typically towards the end of the tax year – you are required to submit the "final" declaration with the proof of investments (receipts etc.). Typically, your organization will expect you to submit your "final" declaration and the proof of investments towards the end of the tax year. Please check with your HR department to get to know the deadline for submission of final declaration.

Submitting a new declaration

If you are submitting a declaration, please be careful with regard to the accuracy of your entries, since your declaration determines your tax calculation. Click on the  image in the right-extreme column in the "Declarations" table to create a new declaration.

image in the right-extreme column in the "Declarations" table to create a new declaration.

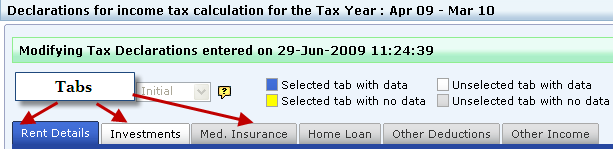

As soon as you click on the  icon, you will see a number of tabs opening at the bottom of the screen for you to submit information.

icon, you will see a number of tabs opening at the bottom of the screen for you to submit information.

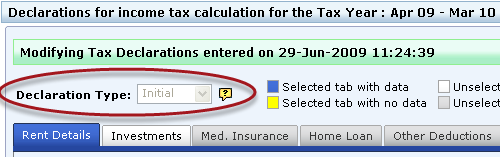

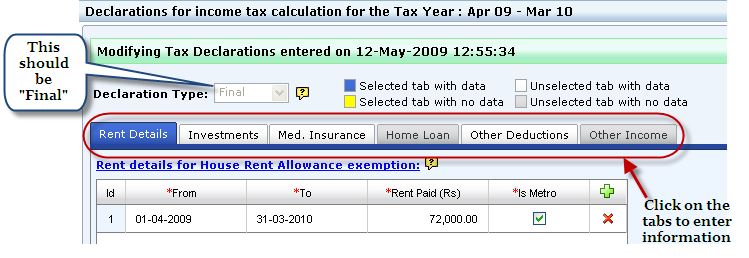

Just above the tabs, you can see the "Declaration Type" field in a disabled mode. At the beginning of a tax year, the value for declaration will be "Initial" and the value changes to "Final" automatically as per the cut-off date specified by your organization.

If you have made any declaration for the year, your last-entered declaration will be displayed in the editable mode as soon as you click on the  image. You can make changes to the values and submit a fresh declaration. Click on the different tabs (Rent Details, Investments etc.) for which you wish to submit information. You can find help files under each of the tabs. Tabs have different colors to distinguish among those that have data and those that do not.

image. You can make changes to the values and submit a fresh declaration. Click on the different tabs (Rent Details, Investments etc.) for which you wish to submit information. You can find help files under each of the tabs. Tabs have different colors to distinguish among those that have data and those that do not.

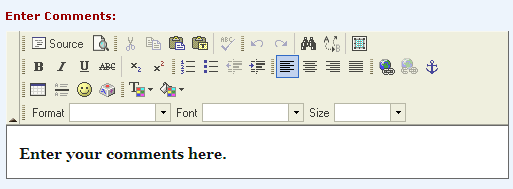

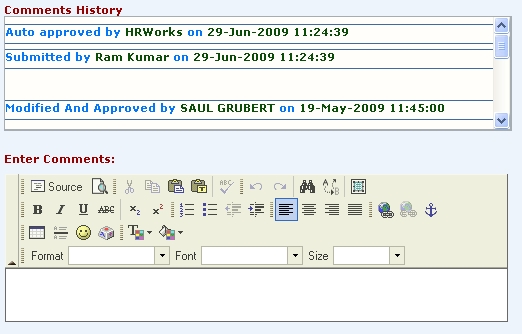

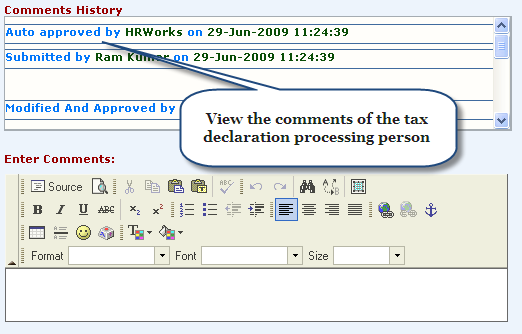

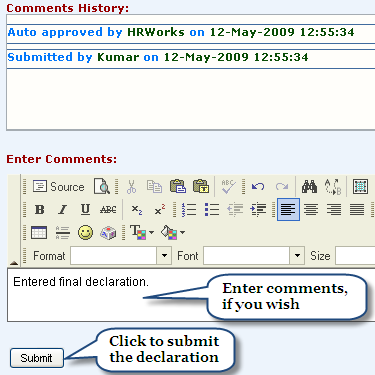

After you submit information under different tabs, you could enter comments in the "Enter Comments" area, if you wish to record any information on the tax declaration.

You will find a number of icons which you can use to format the text you enter inside the "Enter Comments" area. Please note that whatever is entered in the "Enter Comments" area will not affect your tax calculation, and will be stored only for the sake of display.

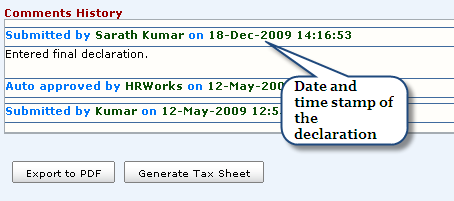

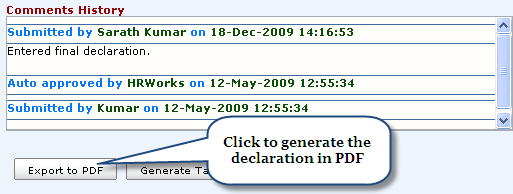

Above the "Enter Comments" area, the "Comments History" text area presents information on earlier declarations -- the date and time of entry and the name of persons who submitted and authorized them and your comments, if any, recorded in earlier declarations. The "Comments History" text area presents information in the read-only mode.

Whenever you submit comments, you will find the comments appearing in the "Comments History" area with a heading which presents the name of the person who entered the comments along with the date and time of the entry.

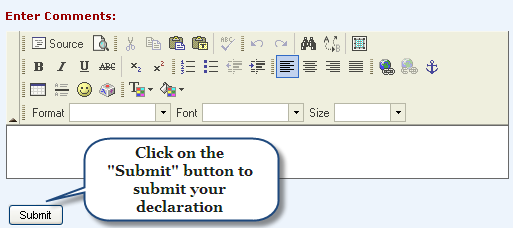

Submitting your declaration

If you have completed entering the declaration, please submit the same by clicking on the "submit" button at the bottom of the screen.

If your submission is successful, you will find a new entry in the "Declarations" table.

Viewing an earlier-submitted declaration

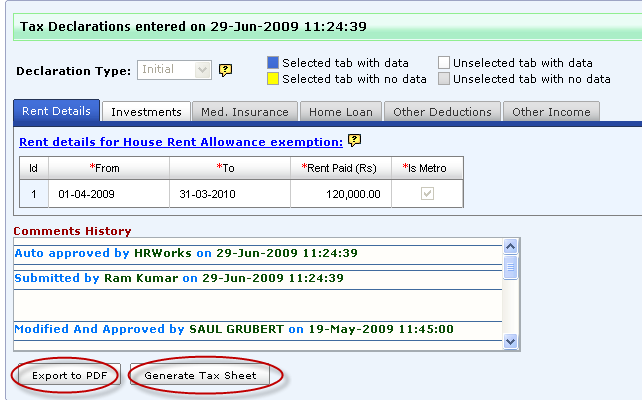

As soon as you submit your declaration, please click on the  icon in the "Declarations" table to view a declaration already submitted. You would find information in the declarations displayed in the read-only mode. At the bottom of the declarations screen, you can click on the "Export to PDF" and "Generate Tax Sheet" buttons.

icon in the "Declarations" table to view a declaration already submitted. You would find information in the declarations displayed in the read-only mode. At the bottom of the declarations screen, you can click on the "Export to PDF" and "Generate Tax Sheet" buttons.

By clicking on the "Export to PDF" button, you can open details of the declaration you have made in the PDF format. When you submit your final declaration towards the end of a tax year, please take a print out of the declaration and attach it to the receipts of investments/expenditures and submit it to your HR department.

Tax Sheet

By clicking on the "Generate Tax Sheet" button, you can open a report (called Tax Sheet) which presents your tax information for the year. If the tax sheet is password protected, you have to enter the password when you open the PDF tax sheet.

Default password assigned by Tanqaa

The password comprises your employee ID/No. in full, followed by your date and month of birth (in DDMM format). The password is case sensitive in case your employee ID/No. is alpha numeric.

Example 1

If your employee ID/No. is 1 and your date of birth is 05-11-1980, then your password will be 10511.

Example 2

If your employee ID/No. is A-1002 and your date of birth is 08-09-1976, then your password will be A-10020809.

Please note that if your employee ID/No. or date of birth is incorrectly entered in Tanqaa, you may not be able to open your tax sheet since the password you enter may not correspond to the information in Tanqaa. If your password does not work, please notify your HR department and request them to raise the issue with us.

You can create your own password

If you do not wish to use the default password, you can specify your own password for tax sheets by logging into Tanqaa, and entering your password on the "Preferences" screen. The "Preferences" link is located on top right, on the screens of Tanqaa.

To open the payslip PDF file, you need Adobe Acrobat Reader version 6.0 or above. Please note that you will not be able to open the file or view the file properly with any version lower than Adobe Acrobat Reader 6.0.

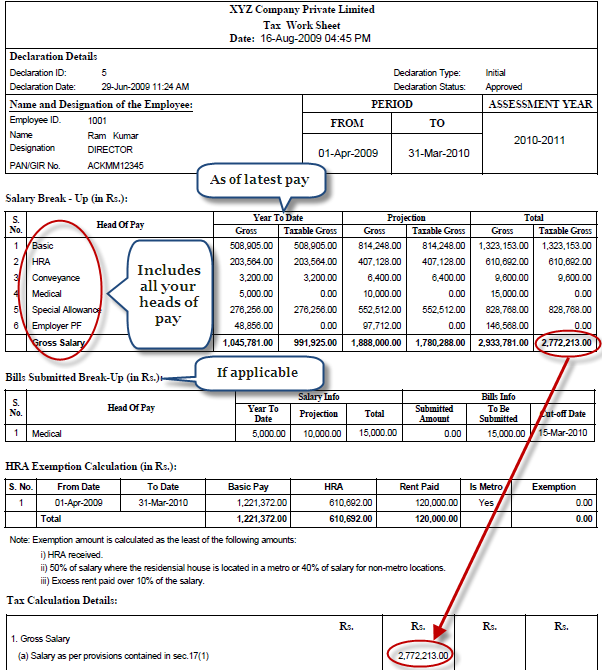

How to Read Your Tax Sheet

The tax sheet appears in a PDF file as follows.

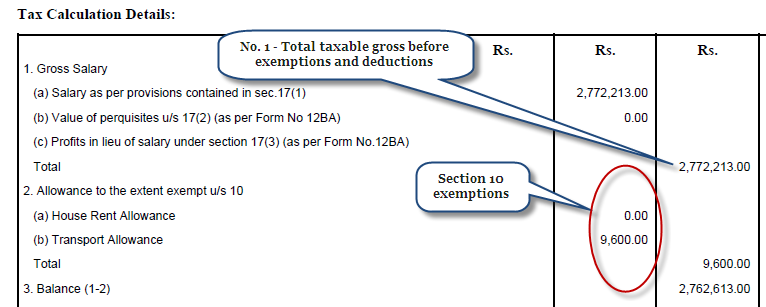

The field (No. 1) Gross Salary presents your total gross salary, inclusive of perquisites for the year.

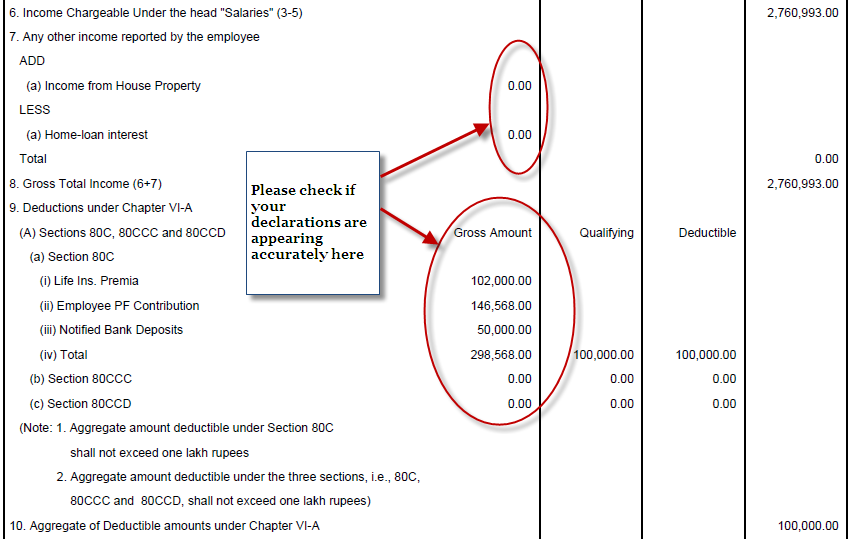

Please check if the tax declaration information you entered are appearing in the tax sheet.

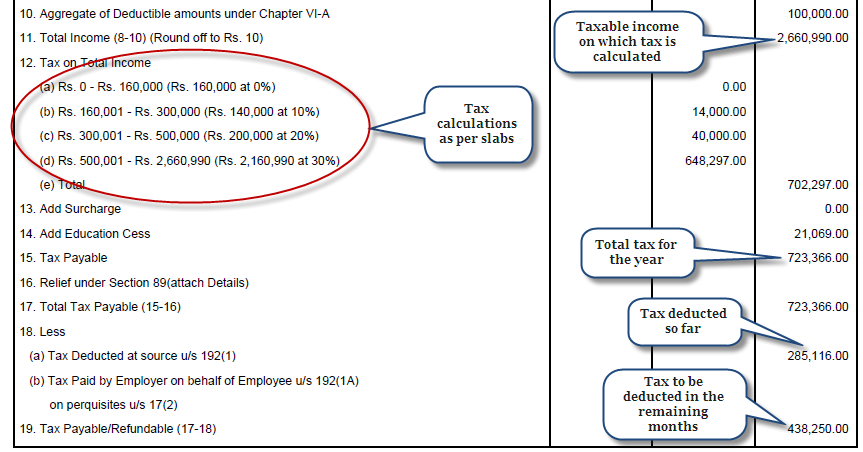

The field Total Income (No. 11) presents your total taxable income for the year. This is the figure on which the tax rate is applied to calculate your total tax, surcharge (if any) and education cess, which is presented in the field Tax Payable (No. 15.)

All the figures presented in the report are as of the date and time of report generation. The Gross Salary figure in the report is the total of the salary you have received till the time of report generation and the salary (for the period after report generation) that you would be receiving till the end of the tax year. If your salary undergoes a change in future before the end of the year or if you resubmit your tax related declarations with changes or if tax rules undergo a change, the salary and tax figures may change.

The figures under "Deductions under Chapter VIA" (No. 9) present the details -- such as insurance premium payments, under sections such as 80 C -- of your latest approved tax related declaration. If any of the figures in your last approved tax related declaration is not found here, please contact us by sending an email to support@tanqaa.in.

Whenever you submit a tax related declaration, as soon as the declaration is approved, you would see a change in the tax figures in Tax Sheet. In order to understand the impact of any tax related declaration on your tax liability, you could look at the Tax Sheet.

If after submitting your declaration, if you find that there is no reduction in your tax in the next month's pay, please check your tax declaration. Your organization may have rejected your tax declaration if it was not in order. In such a case, you may be asked to re-submit your declaration with corrections. You can view the comments of the tax declaration processing person in the "Comments History" area, if your declaration has been rejected. After reading the comments, you can correspondingly re-submit your declaration.

In case your organization requires each declaration to go through an approval process, your declaration may not be considered for tax calculation even if it is in order, as long as it has not been approved by the declaration approving person in your organization.

Each month, there is a cut-off date -- typically, the 25th -- for acceptance of tax declarations for that month's payroll. If you happen to submit your tax declaration beyond the cut-off date, your declaration, even if it approved, will only be considered for tax calculation during the payroll run in the next month. Please check with your HR/Finance department to get to know the monthly cut-off date for acceptance of tax declaration for each month.

Please note that if you leave your organization in the middle of a year, you should resubmit your latest initial declaration as the final declaration (along with proof for house rent payments, investments such as insurance premium etc.) for Tanqaa to recognize your declaration -- for tax calculation during final settlement preparation. If you do not resubmit your initial declaration as a final declaration, all tax exemptions given on the basis of your initial declaration will be reversed and Tanqaa will charge full tax to your final settlement amount.

Tanqaa allows resubmission of a final declaration in the event of an error in an earlier submission, subject to the tax declaration approver in your organization allowing the same. However, once a final declaration is made, an employee cannot make another declaration (other than resubmission of the final declaration) by calling it either initial or final declaration.

Declaration approval

If your tax related declaration has to undergo an approval process (as specified by your organization) before it can be taken for your tax calculation, we suggest that you visit the tax related declaration screen a few days after submitting the declaration to check if the declaration has been approved. If the declaration has been rejected, you may have to resubmit your declaration as per the instructions of the approving authority in your organization. You will be able to see the instructions from the approving authority in the "Comments History" area on the declaration screen.

Final Declaration

Submitting "Final" declaration in Tanqaa

At the end of each tax year, you will be required to submit your final declaration for the year and submit proof of investments to your organization. The cut-off date for acceptance and last date of submission of final declaration are specified in Tanqaa by your organization. Once the cut-off dates are specified for final declaration, you will be able to submit the final declaration for the year.

Click the  icon to view the tax declaration screen at the bottom.

icon to view the tax declaration screen at the bottom.

If you had submitted any declaration for the year earlier, you would see the last submitted declaration being displayed. You can edit the last submitted declaration and submit it as final declaration. In case you are submitting the declaration for the first time in the year, you will see a blank screen in which you can make entries.

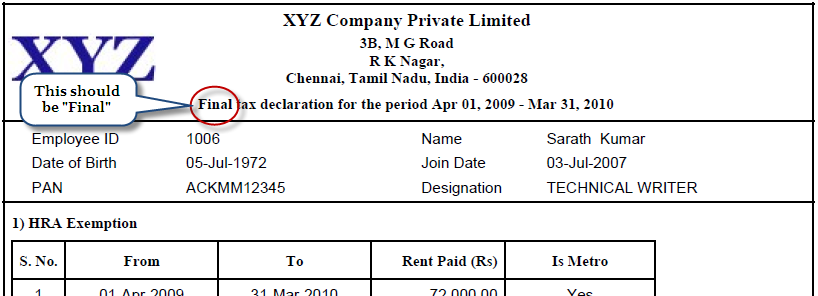

Please note that this will be your final declaration for the year. On the screen, you will be able to see “Final” for the Declaration Type field by way of a disabled dropdown (please see the screenshot below).

Fill in the tax declaration information on the screen. After you complete entering the declaration, scroll down to the bottom of the screen and click the “Submit” button.

As soon as you submit the declaration, you will see an entry bearing the time stamp in the “Comments History” area. If you do not see the date and time of submission in the “Comments History” area, you should assume that your declaration has not been recorded by Tanqaa and you have to submit your declaration once again.

Once you have submitted your declaration, you will not be able to modify it. In case you made a mistake while submitting the declaration, please send a mail to support@tanqaa.in, specifying your company name and employee ID, asking us to reverse the declaration so that you can submit the correct declaration.

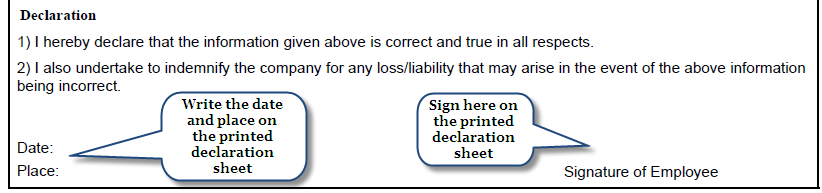

After you submit the declaration, click the “Export to PDF” button at the bottom of the screen. You would see the declaration sheet opening in a PDF file.

In the PDF file, you should see “Final Declaration” in the title. If you see “Initial Declaration” please re-submit your declaration and take a print out of the declaration.

Print the PDF file, and affix your signature on the last page of the declaration sheet.

Please go through the declaration sheet to check if all your entries have been accurately presented. Submit the control sheet stapled along with the receipts of your investments to your HR/Finance department. Please note that all house rent, home loan, and investments stated in the declaration should have a corresponding receipt. If receipts are not furnished, your declaration may be rejected, and consequently your tax liability may go up.

As soon as you submit the final declaration, Tanqaa would consider your submission and re-calculate tax for the year under the assumption that your final declaration will be supported by investment proof. In case your investment proof is not found to be in order, your declaration may be rejected by your organization. In such a case, Tanqaa would reverse tax rebates given to you and your tax liability may go up in the next pay out.

Copyright , Tandem Integrated Business Solutions Private Limited