Topics

How to Enter House Rent Information?

How is Tax Exemption of House Rent Allowance Calculated?

Proof Submission for Payment of House Rent

How to Enter House Rent Information?

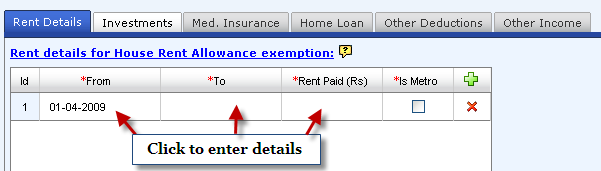

Click on the "Rent Details" tab for submitting house rent information.

Once you click on the Rent Details tab, you can see the table titled "Rent details for House Rent Allowance exemption."

As soon as you click on the  icon on top of the right extreme column in the table, you will see a row with blank fields where you can enter details of house rent that you have paid or will be paying for the year. Please click on the respective cells to update the required details.

icon on top of the right extreme column in the table, you will see a row with blank fields where you can enter details of house rent that you have paid or will be paying for the year. Please click on the respective cells to update the required details.

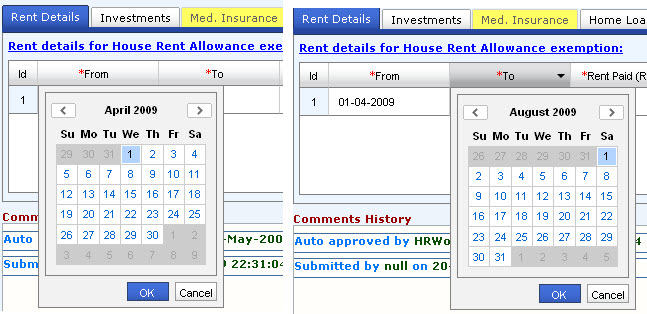

The default "From" field value is April 1 of the current tax year. If you wish to change this value, click on the cell and use the calendar that pops-up. The "from" date value has to fall within the financial year (April to March) to which the declaration pertains.

In order to enter the "To" date value, click on the cell and use the pop-up calendar. The "To" date has to fall within the financial year (April to March) to which the declaration pertains.

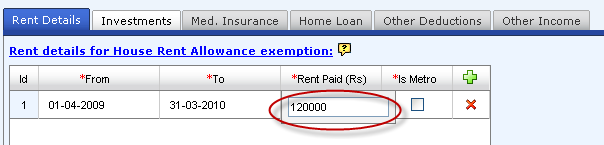

Please enter the rent amount paid for the accommodation in the "Rent Paid" field. Click on the field and use the input box which pops up. The entry has to be a number with a maximum of two decimal places.

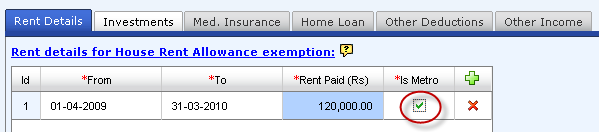

"Is Metro" - Please select the check box if the house is located in Delhi, Mumbai, Kolkata, or Chennai. If the house is not located in a metro city, leave the check box blank.

You can create as many rows as you wish to enter rent details, in case of change in accommodation or rent during a year, by clicking on the  image.

image.

Please note that you should not enter monthly or quarterly rent information but enter information as per the dates during which you occupied the accommodation.

Example 1

In the year 2009, if you stayed in two houses, both in a metro city, stated as follows:

House 1: From June 1 to July 15 – Rs 6000 per month is the rent. You paid Rs 9000 since you stayed in the house for a month and half.

House 2: From July 16 to July 31 – Rs 10, 000 per month is the rent. You paid Rs 5000 for the 15 days from July 16 to July 31, 2009.

Then please DO NOT enter the information, by splitting the rent paid into monthly periods, as follows:

From Date |

To Date |

Rent Paid (Rs) |

Is Metro |

01-Jun-2009 |

30-Jun-2009 |

6,000 |

Selected |

01-Jul-2009 |

31-Jul-2009 |

8,000 |

Selected |

Instead, the correct entry is as follows.

From Date |

To Date |

Rent Paid (Rs) |

Is Metro |

01-Jun-2009 |

15-Jul-2009 |

9,000 |

Selected |

16-Jul-2009 |

31-Jul-2009 |

5,000 |

Selected |

Tanqaa, on the basis of the dates of accommodation, will calculate the HRA exemptions for adjustments in your gross pay.

Example 2

If you stay in one house in a metro city for the whole year (April 2009 to March 2010) by paying Rs 10,000 per month as rent then there should be only one entry as follows.

From Date |

To Date |

Rent Paid (Rs) |

Is Metro |

01-Apr-2009 |

31-Mar-2010 |

1,20,000 |

Selected |

Even if you stay in one house for the whole year and if there are rent revisions during the year, you will need to make different entries for each revision. For example, in the year 2009, if you stayed in only one house, in a metro city, but the rent was revised as follows,

House 1: From Apr 1 to Sep 30 – Rs 6000 per month is the rent. You paid Rs 36,000 since you stayed in the house for 6 months.

House 1: From Oct 01, 2009 to March 31, 2010 – Rs 10, 000 per month is the rent. You paid Rs 60,000 for 6 months.

Then please do not enter the information, by making just one entry, as follows:

From Date |

To Date |

Rent Paid (Rs) |

Is Metro |

01-Apr-2009 |

31-Mar-2010 |

96,000 |

Selected |

Instead, the correct entry is as follows.

From Date |

To Date |

Rent Paid (Rs) |

Is Metro |

01-Apr-2009 |

30-Sep-2009 |

36,000 |

Selected |

01-Oct-2009 |

31-Mar-2010 |

60,000 |

Selected |

Tanqaa, on the basis of the dates of accommodation, will automatically calculate the HRA exemptions for adjustments in your gross pay.

Every time you submit a new declaration, you can choose to change the rent details as you wish. However, please note that amounts in the rent receipts (whether monthly or any other periodicity), should equal amounts entered in the tax declaration whenever you submit rent receipts to your organization.

How is Tax Exemption for House Rent Allowance (HRA) Calculated?

As per the Indian income tax law, the following is the exemption calculation in respect of HRA received.

The least of the following is exempted:

Please note that in order to avail HRA exemption:

As per the logic that drives HRA exemption calculation in Tanqaa, whenever any of the above parameters (Basic pay, Rent paid, HRA, Metro or Non-metro) changes for an employee during a year, the HRA exemption is calculated. In other words, a year is divided into as many periods as dictated by changes in any of the above parameters, and HRA exemption is calculated for each of the periods. Finally, the HRA exemption amounts for the different periods are aggregated to compute the HRA exemption amount for the year.

The following illustrations describe the HRA exemption calculation logic.

Illustration 1 When there is no change in any of the parameters through the year

In this case, the total is just one period since none of the parameters have changed during the year. The HRA exemption is calculated as follows. The least of the following:

The least of the above is Rs 48,000. ---------------------------------------------------------------------------------------------- Illustration 2 When there is loss of pay Let us assume that the employee, in the above case, has loss of pay for one month in September while all other variables (rent, place of residence etc. remain the same). In this case, the HRA exemption is calculated for 3 periods in the year. Period 1 – April 1 to August 31 Period 2 (pertaining to loss of pay) – September 1 to September 30 Period 3 – October 1 to March 31 HRA exemption calculation for Period 1

The least of the following:

The least of the above is Rs 20,000. HRA exemption calculation for Period 2

The least of the following:

The least of the above is Rs 0. HRA exemption calculation for Period 3

The least of the following:

The least of the above is Rs 24,000. The total annual exemption in this case is sum of HRA exemptions for the three periods in the year = Rs 20,000 + Rs 0 + Rs 24,000 = Rs 48,000 It may be noted that the annual HRA exemption amount will be different if instead of segregating a year into different periods, all the parameters are projected at the annual level, and the HRA exemption is calculated. |

The above illustrations present HRA exemption calculation on account of changes to Basic pay. In the event of Basic or HRA not changing but the rent amount changing or the location of the residence changing (say, from metro to non-metro), the year is divided into as many periods, and the HRA exemption amounts are calculated for each period and aggregated for the year.

It may be noted that Tanqaa facilitates employees to submit rent information as per the exact period of their stay in a rented house or any rent change. Tanqaa does not force employees to submit monthly or annual rent information. For example, if an employee stays in a rented house from April 1 to May 14, and then moves to another house and stays there from May 15 to March 31 of next year, and if all other variables such as Basic pay and HRA remain the same, Tanqaa shall segment the year into two periods -- April 1 to May 14 and May 15 to March 31 of next year – for HRA exemption calculation.

HRA Exemption Calculation on Account of HRA Arrears

HRA exemption calculation is done for the different periods in a year, and aggregated in order to present the annual HRA exemption calculation, on Tanqaa.

Whenever HRA is paid with retrospective effect (arrear pay), the tax engine in Tanqaa computes HRA exemption for the period to which the underlying HRA belongs, irrespective when the HRA amount is actually paid.

Illustration 3 HRA exemption for HRA arrears pertaining to the previous year HRA exemption calculated in a year ending on March 31

In this case, the total is just one period since none of the parameters have changed during the year. The HRA exemption is calculated as follows. The least of the following: 1. Rent paid in excess of 10% of basic salary = Rs 48,000 2. Actual HRA received = Rs 60,000 3. 50% of basic salary (if metro) = Rs 60,000 The least of the above is Rs 48,000. In April payroll, a pay hike is introduced with retrospective effect from January of the previous tax year. With effect from January of the previous year, the compensation is revised as follows.

HRA exemption calculated for the new tax year, in April

The HRA exemption is the least of the following:

The least of the above is Rs 32,000. On Tanqaa, due to arrear pay pertaining to January to March, the previous year is divided into two periods (Apr to Dec and Jan to Mar on account of the pay hike), and the HRA exemption for the previous year will be recomputed as follows. HRA exemption calculation for Period 1 (April to December)

The least of the following:

The least of the above is Rs 45,000. HRA exemption calculation for Period 2 (January to March)

The least of the following:

The least of the above is Rs 9,000. The total annual exemption in this case is sum of HRA exemptions for the two periods in the year = Rs 45,000 + Rs 9,000 = Rs 54,000. |

NOTE:

When HRA arrears pertaining to a year are paid in the next tax year, the earlier year’s HRA exemption will be re-computed and the previous year’s annual tax calculation and the corresponding Form 16 values will be changed.

Illustration 4 HRA exemption for HRA arrears pertaining to the same tax year Salary and rent information at the beginning of a new tax year, in April

In July payroll, a pay hike is introduced with retrospective effect from April of the same tax year. With effect from April of the same tax year, the compensation is revised as follows.

On Tanqaa, on account of the arrear pay pertaining to April to June, the year is divided into two periods (Apr to Jun and Jul to Mar on account of the pay hike) and the HRA exemption for the year is recomputed in July payroll as follows. HRA exemption calculation for Period 1 (April to June)

The least of the following: 1. Rent paid in excess of 10% of basic salary = Rs 12,000 2. Actual HRA received = Rs 15,000 3. 50% of basic salary (if metro) = Rs 15,000 The least of the above is Rs 12,000. HRA exemption calculation for Period 2 (January to March)

The least of the following: 1. Rent paid in excess of 10% of basic salary = Rs 27,000 2. Actual HRA received = Rs 90,000 3. 50% of basic salary (if metro) = Rs 90,000 The least of the above is Rs 27,000. The total annual exemption in this case is sum of HRA exemptions for the two periods in the year = Rs 12,000 + Rs 27,000 = Rs 39,000 |

Proof Submission for Payment of House Rent

Towards the end of a year or when you leave your organization, please submit the original house rent receipt as proof of having paid rent for your house, to your organization. The format of the rent receipt should be as per your organization's instructions.

Further if annual rent paid by the employee exceeds Rs. 1,00,000 (One Lakh) per annum (monthly rent of more than Rs.8,333), as per Notification No.30/2016, dated 29th April, 2016, it is mandatory for the employee to report Name, Address and PAN of the landlord/landlords to the Employer.

Copyright , Tandem Integrated Business Solutions Private Limited