Topics

How to Enter Information on Investment in Infrastructure Bonds?

How does Your Investment under Section 80CCF Impact Tax Calculation?

Proof Submission for Investment in Infrastructure Bonds

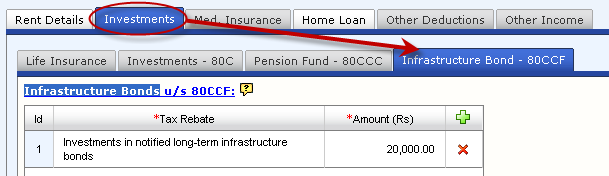

How to Enter Information on Investment in Infrastructure Bonds?

In the table titled "Infrastructure Bonds under Section 80CCF", you will see the message, "No data found" if there is no prior declaration. Click the ![]() icon on top of the right extreme column in the table. As soon as you click the

icon on top of the right extreme column in the table. As soon as you click the ![]() icon inside the table, you will see a row with blank fields. In the blank row, please enter value for the Amount, as follows.

icon inside the table, you will see a row with blank fields. In the blank row, please enter value for the Amount, as follows.

Field |

Instruction |

Tax rebate |

The text "Investments in notified long-term infrastructure bonds" appears in the read-only mode. |

Amount |

Please click the field enter the total amount of investment for the year. The amount can have a maximum of 2 decimal places. |

You can create as many rows as you wish to enter details of all your investments made during the year by clicking the ![]() icon. If you wish to delete any of the rows, you could do so by clicking on the

icon. If you wish to delete any of the rows, you could do so by clicking on the ![]() icon at the end of the row.

icon at the end of the row.

How does Your Investment under Section 80CCF Impact Tax Calculation?

Your investments allow you to get a tax reduction under the so-called "Deductions under Chapter VI-A" of the Income Tax Act. While an employee can investment any amount under Section 80CCF, a maximum of Rs 20,000 can be deducted from an employee's gross total income while arriving at the taxable income.

Proof Submission for Investment in Infrastructure Bonds

Investment under Section 80CCF |

Proof to be submitted |

Guidelines |

Infrastructure Bonds |

Photocopy of receipt/bond |

Receipts/statements/bonds/certificates should be of the current year only |

Whenever you submit receipts to your organization, amounts in the investment receipts should be the same as the amounts entered in the tax declaration screen of Tanqaa.

Copyright , Tandem Integrated Business Solutions Private Limited