Topics

How to Enter Information on Investments under Section 80C?

How do Your Investments under Section 80C Impact Tax Calculation?

Proof Submission for Investments under Section 80C

How to Enter Information on Investments under Section 80C?

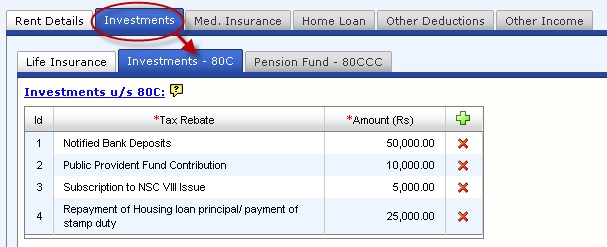

In the table titled "Investments under Section 80C", you will see the message, "No data found" if there is no prior declaration.

As soon as you click on the ![]() icon on top of the right extreme column in the table, you will see a row with blank fields appearing inside the table, where you can enter details of investments under section 80C you have made or will be making for the year. Please click on the respective cells to see a drop down of investment options available. Select a value from the drop down list to update the required details.

icon on top of the right extreme column in the table, you will see a row with blank fields appearing inside the table, where you can enter details of investments under section 80C you have made or will be making for the year. Please click on the respective cells to see a drop down of investment options available. Select a value from the drop down list to update the required details.

You can create as many rows as you wish to enter details of all your investments made during the year by clicking on the ![]() icon. If you wish to delete any of the rows, you could do so by clicking on the

icon. If you wish to delete any of the rows, you could do so by clicking on the ![]() icon at the end of the row.

icon at the end of the row.

Field |

Instruction |

Tax rebate |

Please select the appropriate tax rebate avenue for which you wish to make the declaration by using the drop down. |

Amount |

Please enter the total amount of investment/payment. The amount can have a maximum of 2 decimal places. |

How do Your Investments under Section 80C Impact Tax Calculation?

Your investments allow you to get a tax reduction under the so-called "Deductions under Chapter VI-A" of the Income Tax Act. While an employee can investment any amount under different heads, a maximum of Rs. 1,50,000 (1.5 Lakhs) can be deducted from an employee's gross total income while arriving at the taxable income.

An employee will be entitled to deductions for the whole of amounts paid or deposited in the current financial year, subject to a limit of Rs. 1,50,000 (1.5 Lakhs) under section 80C. Please note that there are no sub-limits under any of these investments. Therefore you can even claim tax rebate for the entire amount under any of the investments options. In addition, investments under Section 80C and under 80CCC (Pension fund) should be added while considering the Rs. 1,50,000 (1.5 Lakhs) limit.

Note:

1. Bank deposits, in order to be considered for deduction under Section 80C, should be the so-called "notified bank deposits." In other words, any bank deposit will not qualify for tax deduction. Please check with the bank in which you make deposit on whether the deposit qualifies for tax deduction.

2. Public provident fund, an investment avenue under Section 80C, is in addition to and different from the provident fund contribution amount which your organization may be deducting from your salary. If your organization deducts provident fund contribution from your salary, Tanqaa would automatically consider it for your tax rebate without your entering the information.

3. If you have a housing loan, the principal repaid for the year, should be entered under "Investments."

Proof Submission for Investments under Section 80C

The details for various investment options along with the required proof and guidelines are given below for your reference.

Investment under Section 80C |

Proof to be submitted |

Guidelines |

Public Provident Fund (PPF) |

Photocopy of stamped challan or PPF passbook |

|

National Saving Certificate Interest (NSC) |

Photocopy of receipts/ certificates |

Receipts/statements/bonds/certificates should be of the current year only |

NSC interest |

Photocopy of all the certificates for which interest is being claimed |

NSC interest declared will also be accounted as "Other Income" and taxed. |

Fixed Deposit in a Scheduled Bank |

Photocopy of the receipt/ certificate issued by the scheduled bank |

Term deposits for a minimum period of 5 years with a scheduled bank are eligible for deduction. |

Unit Linked Investment Plan |

Photocopy of receipts statement |

Receipts/statements/bonds/certificates should be of the current year only |

Mutual Funds/ Equity Linked Saving Scheme |

Photocopy of receipts/ statement – specified funds only |

Receipts/statements/bonds/certificates should be of the current year only |

Infrastructure bonds |

Photocopy of Receipts/ Bond |

Receipts/statements/bonds/certificates should be of the current year only |

Postal deposits |

Photocopy of the stamped challan or Passbook |

Receipts/statements/bonds/certificates should be of the current year only |

Children education fees |

Tuition fees paid supported by receipts issued by the school, college, university or educational institution |

|

Deposit under Senior Citizens Saving Scheme |

Amount deposited under senior citizen saving scheme |

|

Five year Time Deposit Scheme in Post Office |

Copy of the receipt/ certificate issued by the post office |

|

Housing Principal Registration/ Stamp Duty |

Provisional Certificate from the Financial Institution/ Bank Photocopy of Sale Deed and Stamp Duty Paid Receipt to be attached |

|

Whenever you submit receipts to your organization, amounts in the investment receipts should be the same as the amounts entered in the tax declaration screen of Tanqaa.

Copyright , Tandem Integrated Business Solutions Private Limited