Topics

How to Enter Medical Insurance Information?

How Does Medical Insurance Reduce Your Tax?

Proof Submission for Medical Insurance

How to Enter Medical Insurance Information?

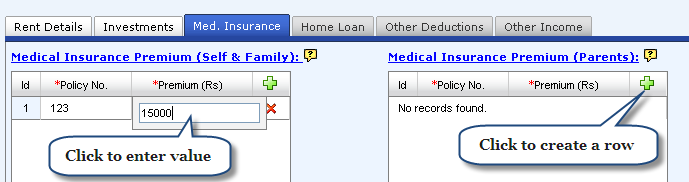

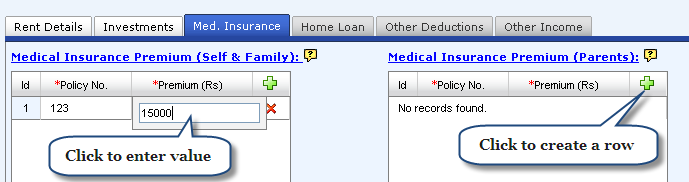

Under the "Med. Insurance" tab, you can enter information on the following, for tax rebate under section 80D.

As soon as you click on the ![]() icon on top of the right extreme column in the table, you will see a row with blank fields appearing inside the table, where you can enter details of premium that you have paid or will be paying for the year. Please click on the respective cells to update the required details.

icon on top of the right extreme column in the table, you will see a row with blank fields appearing inside the table, where you can enter details of premium that you have paid or will be paying for the year. Please click on the respective cells to update the required details.

Field |

Instruction |

Policy No. |

Please enter the insurance policy number. If you do not have a value for this field, please enter "TBE." TBE stands for "To Be Entered." Tanqaa forces you to make an entry because this field is a mandatory field. |

Premium |

Please enter the total annual premium amount (in Rs). The amount can have a maximum of two decimal places. |

You can create as many rows as you wish to enter details in the respective fields by clicking on the ![]() icon. If you wish to delete any of the rows, you could do so by clicking on the

icon. If you wish to delete any of the rows, you could do so by clicking on the ![]() icon at the end of the row.

icon at the end of the row.

Please select the "Senior citizens included" check box if any of the policy holders is a senior citizen (over 60 years in age).

How Does Medical Insurance Reduce Your Tax?

You can avail the following tax rebates for medical insurance premium paid under section 80D of the Indian income tax act.

Tax rebate of Rs 15,000 -- In case of medical insurance premium paid for the employee, spouse & children

An employee can also avail additional benefit of

Rs 15,000 -- In case parents below 60 years of age are covered

Rs 20,000 -- In case of parents above 60 years (senior citizens) of age are covered

The above amounts can be deducted from an employee's gross total income while arriving at the taxable income.

Proof Submission for Medical Insurance

The details for the various investment options along with the required proof and guidelines are given below for your reference.

Section 80D |

Proof to be submitted |

Guidelines |

Medical insurance premium such as Mediclaim |

Photocopy of all premium receipts issued by the insurance company along with copy of the insurance policy (indicating name of the persons insured). |

|

Whenever you submit receipts to your organization, amounts in the medical insurance receipts should be the same as the amounts entered in the tax declaration screen of Tanqaa.

Copyright , Tandem Integrated Business Solutions Private Limited