Topics

How to Enter Information Pertaining to Previous Employment?

How is Information Pertaining to Previous Employment Used in Tax Calculation?

Proof Submission for Previous Employment Information

How to Enter Information Pertaining to Previous Employment?

In the current year if you worked for another organization prior to joining the current organization, you can choose to enter salary information pertaining to your previous employment as part of your declaration.

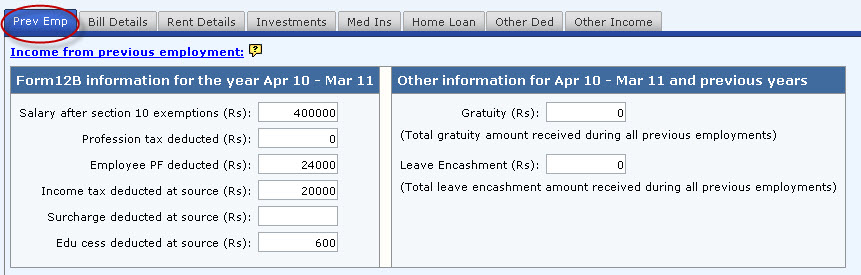

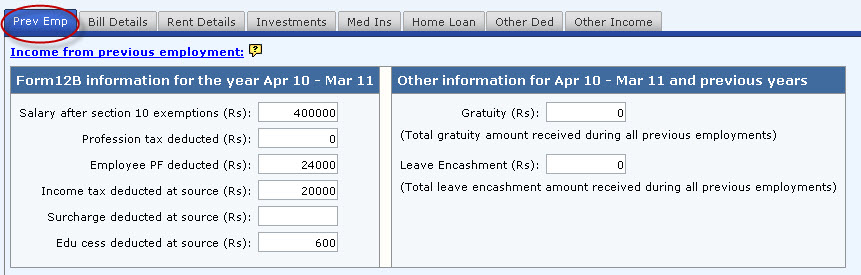

Click on the "Prev Emp" tab for submitting the information. Please fill in the fields under the heading "Income from Previous Employment."

Form 12B Information

All the information provided here should pertain only to the current year and exclude information pertaining to earlier years.

Field |

Instruction |

Salary after section 10 exemptions |

Please refer to the tax sheet/Form 16 pertaining to your previous employment and enter the salary amount after Section 10 exemptions such as house rent exemption. |

Profession tax deducted |

Please enter the total amount deducted under profession tax in your previous employment. |

Employee PF deducted |

Please enter the total amount deducted under employee's contribution to provident fund in your previous employment. |

Income tax deducted at source |

Please enter the total income tax amount deducted in your previous employment. |

Surcharge deducted at source |

Please enter the total surcharge amount deducted in your previous employment. |

Edu cess deducted at source |

Please enter the total education cess amount deducted in your previous employment. |

Other Information

All the information provided here should pertain to the current year and earlier years covering the total period of your career until the current year.

Field |

Instruction |

Gratuity |

Please enter the total amount of gratuity you have received from all your previous organizations. |

Leave encashment |

Please enter the total amount of leave encashment you have received from all your previous organizations. |

How is Information Pertaining to Previous Employment Used in Tax Calculation?

Any income pertaining to previous employment will be clubbed with the income from the current employment to arrive at your total annual tax liability. In addition, tax deducted in your previous employment will be considered while calculating the total tax to be deducted by the current employer. Any under or over deduction of income tax in your previous employment will have an impact on the income tax computation for the current employment.

Proof Submission for Previous Employment Information

Please submit Form 16 or tax sheet duly attested by your previous employer as proof for Form 12B information. For the "Other Information" referred to above, you need not submit any proof.

Copyright , Tandem Integrated Business Solutions Private Limited